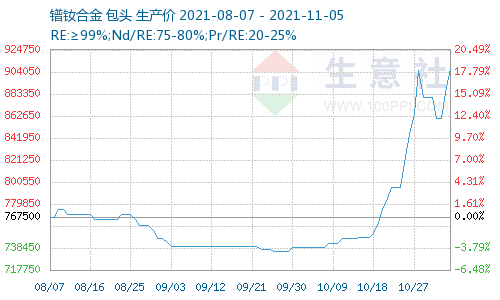

November 5th, 2021 in the 81st auction, all transactions were completed at 930000 yuan / ton for PrNd, and the alarm price was reported for the third consecutive time.

Recently, rare earth prices have stood at an all-time high, attracting market attention. Since October, the price of rare earth has shown an upward trend as a whole. The price of Praseodymium and Neodymium oxide has increased from 598000 yuan / ton in early October to 735000 yuan / ton on October 28, an increase of 22.91%.

Rare earth prices have risen sharply in the past two weeks, especially the price of light rare earth products. In fact, there was a high callback in the rare earth market last Friday. According to this judgment, this round of rare earth market may be more affected by market sentiment. Fundamentally, the market sentiment stems from the panic of power restriction, the lock and reluctant sale of goods at the holding end, and the continuous tightening of supply end. Some analysts said that rare earth prices may continue to remain high in the future.

The supply of rare earths in China is tight, and the holders lock the goods and are reluctant to sell them. For a period of time, upstream enterprises have high expectations for rare earth prices, resulting in those who have stock now do not ship. Of course, due to the shortage of supply, the spot is also very scarce. At present, the enterprises that lock and sell goods are mainly from Sichuan, Fujian, Jiangxi and Inner Mongolia.

In the view of the industry, the transaction price of metal Praseodymium and Neodymium continues to rise, and even continuously refresh the annual maximum transaction price, which is mainly due to the strong downstream demand, the reduction of power supply and production of metal plants, and the reduction of oxide output of separation plants, resulting in insufficient inventory of raw materials and tight spot procurement.

Nevertheless, the shortage of rare earth supply continues. The import of Myanmar’s minerals is restricted, the supply of rare earth minerals is tight, the supply of waste materials is also tight, and the price is strong, which corresponds to the upside down price of Praseodymium and Neodymium oxide. In addition, the prices of auxiliary materials are also rising, and the costs of separation enterprises have increased. In addition, some separation enterprises in Jiangxi, Jiangsu, Zhejiang, Hunan and other places have reduced production, resulting in a continuous shortage of Praseodymium and Neodymium oxide spot supply. With the arrival of the procurement cycle of magnetic material enterprises, the price of Praseodymium and Neodymium has continued to rise recently.

So, will the middle and lower reaches enterprises accept the continuous rise in rare earth prices? Large magnetic material factories mainly focus on long orders. Generally speaking, the long-term single has a one-year period and a half year period, which can avoid the risk of spot price rise to a certain extent, but in the long run, it is inevitable to be affected. For example, some magnetic material factories have reversed the cost and price to varying degrees some time ago.

From August to September this year, the price of metal PrNd was at a high level of 700000 yuan / ton – 750000 yuan / ton, which inhibited the consumption of some medium and low-end Neodymium-Iron-Boron magnets, but the penetration of high-end products in the new energy vehicle industry accelerated. At the same time, driven by power shortage and dual control of energy efficiency, industrial motors have rapidly changed to NdFeB motors. Although the overall output has declined due to the middle and low-end NdFeB magnets, the increase in the proportion of high-end Neodymium magnets also supports the growth of the total demand for rare earths. The market still supports the price of Praseodymium and Neodymium. Under the background of the rapid growth of the output of new energy vehicles and the installed capacity of wind power motors, the demand for NdFeB magnets continues to improve, and the high price of Praseodymium and Neodymium is difficult to fall and continue to improve.

Post time: Nov-05-2021